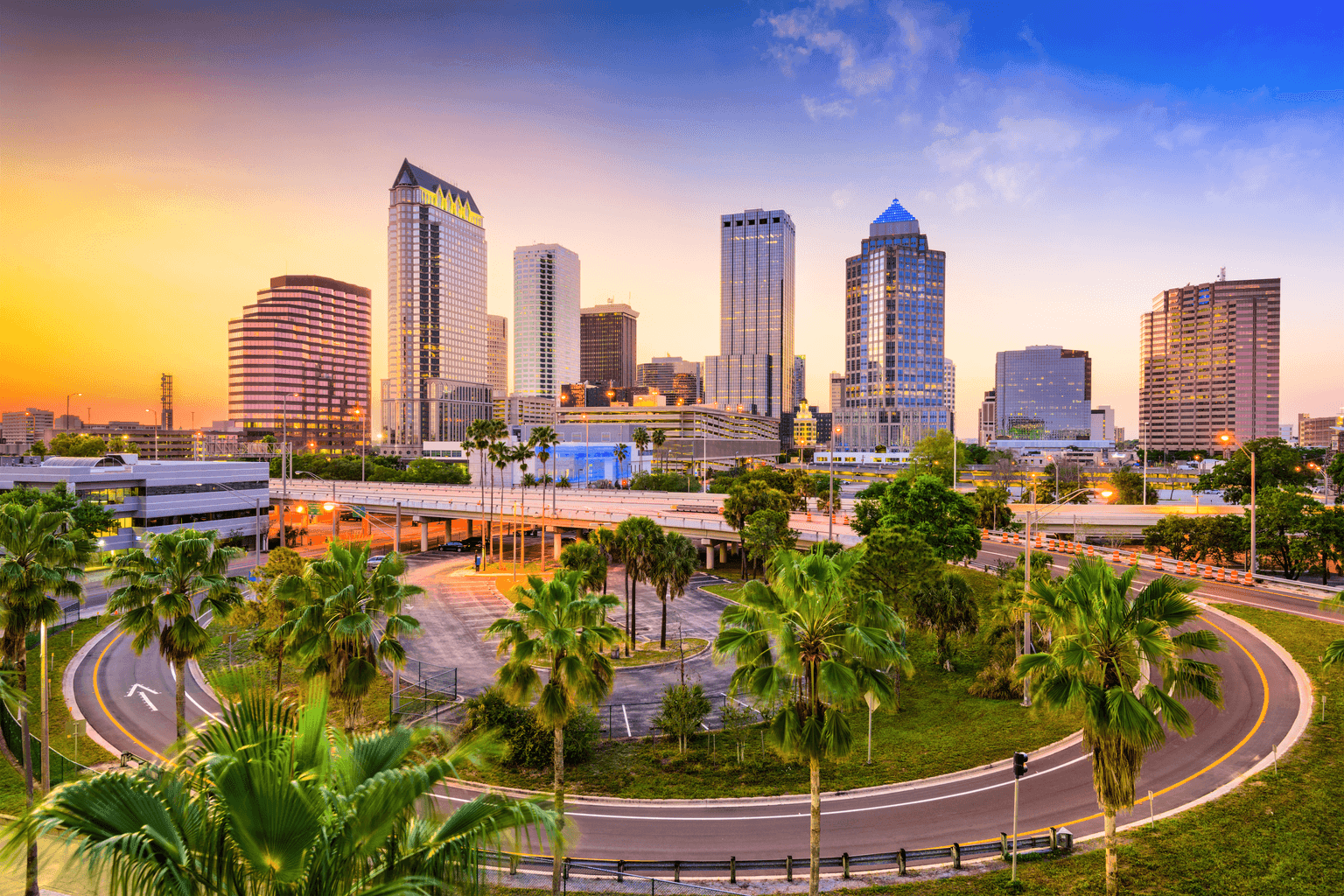

Properties For Sale in Tampa, United states 2026

Discover premium real estate opportunities in one of United states's most sought-after locations.

Skyview Canopy at Ybor

USD 300,000

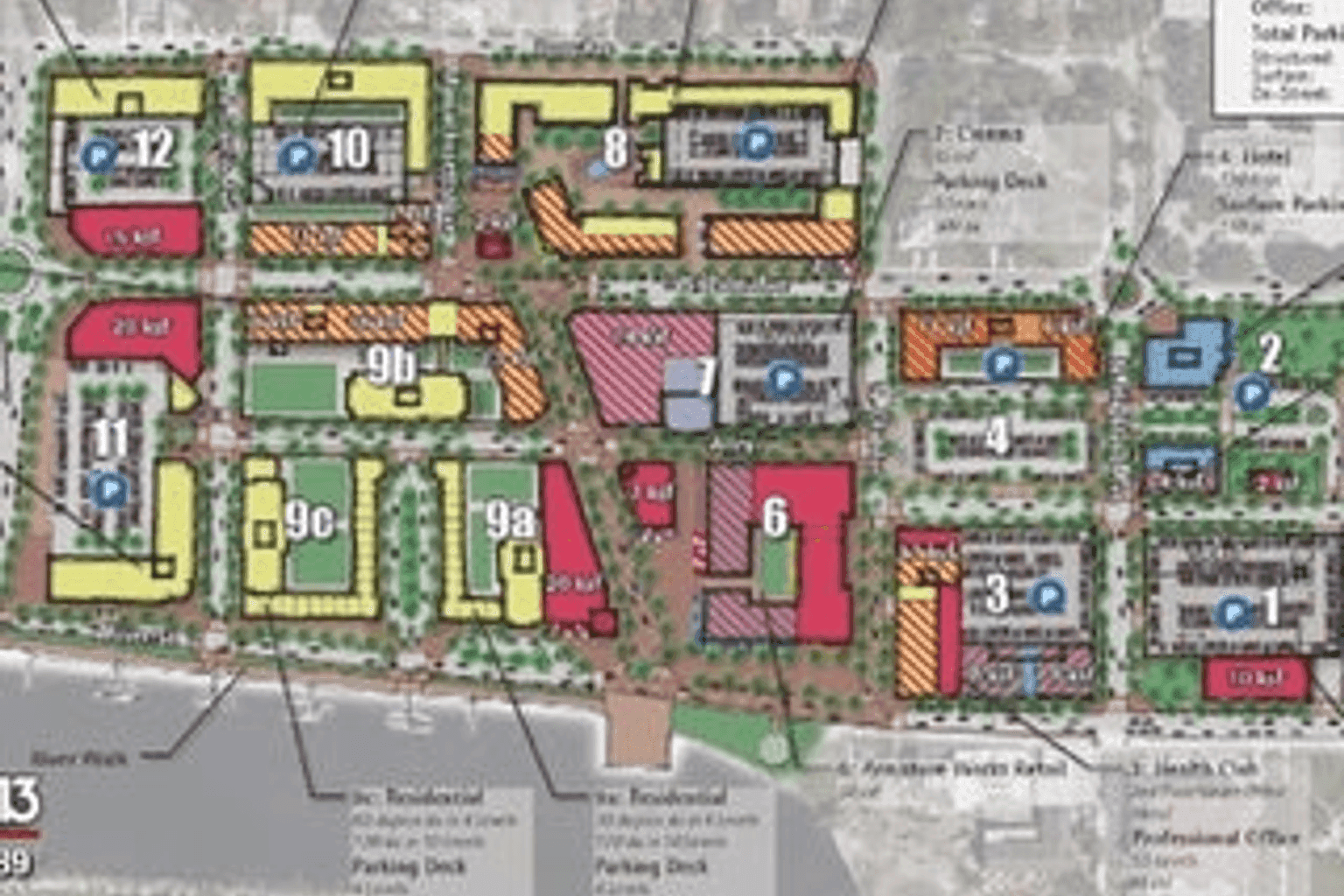

Harbour Island expansions

USD 555,000

€14,230.769/m²

Encore Tampa

USD 790,000

€12,539.683/m²

West River Redevelopment

USD 0

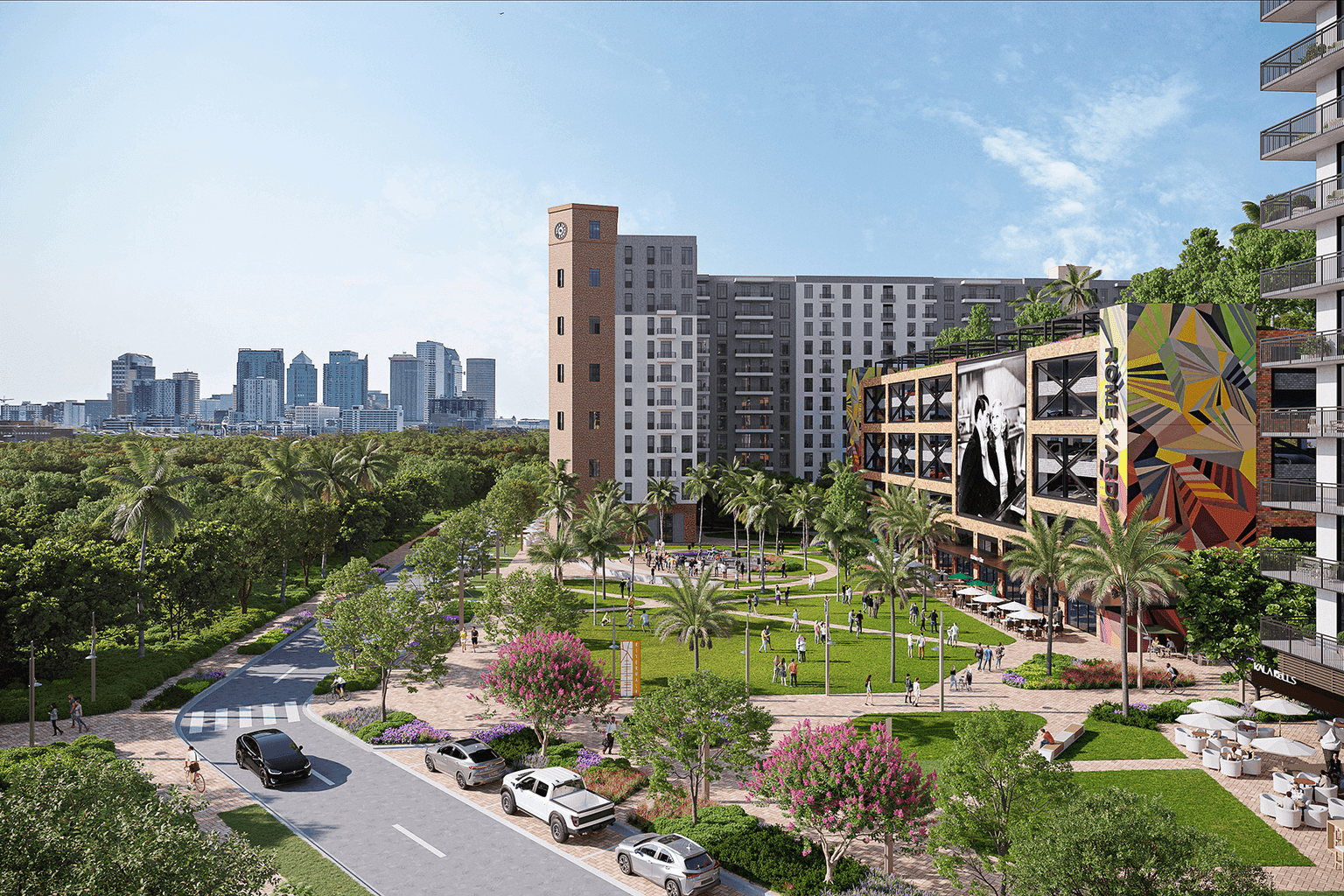

Rome Yard Redevelopment

USD 0

TGH Medical & Housing expansions

USD 0

Heights Union & The Pearl

USD 300,000

€5,555.556/m²

Water Street Tampa

USD 647,000

€10,783.333/m²

Armature Works expansions

USD 0

The Julian Bucs Stadium District

USD 300,000

Tampa Orien Wharf Concept

USD 0

Channel Club

USD 400,000

Residences at Gandy

USD 300,000

€4,761.905/m²

The Boulevards at West River

USD 400,000

€6,349.206/m²

Trusted by International Investors

Over 10,000+ successful property investments facilitated in Tampa

Other Cities near Tampa

Explore investment opportunities in nearby cities within United states.

New York

Explore properties in New York, United States

Avg. Price: €

2500 properties available

Los Angeles

Explore properties in Los Angeles, United States

Avg. Price: €

2000 properties available

Miami

Explore properties in Miami, United States

Avg. Price: €

1600 properties available

Atlanta

Explore properties in Atlanta, United States

Avg. Price: €

400 properties available

Financing & Legal Information

Essential information for property investment in United states.

Financing Options

- Max LTV:70%

- Interest Rates:3.0-5.0%

- Loan Terms:Up to 30 years

Legal Considerations

- Foreign Ownership:Freely allowed

- Process Time:Typically 8-12 weeks

Key Requirements:

Find Your Perfect Property in Tampa

Our local specialists are ready to assist you. Get personalized property recommendations and expert guidance.