Properties For Sale in Kansas city, United states 2026

Discover premium real estate opportunities in one of United states's most sought-after locations.

Union Hill Redevelopment

USD 1,000,000

West Bottoms Flats

USD 200,000

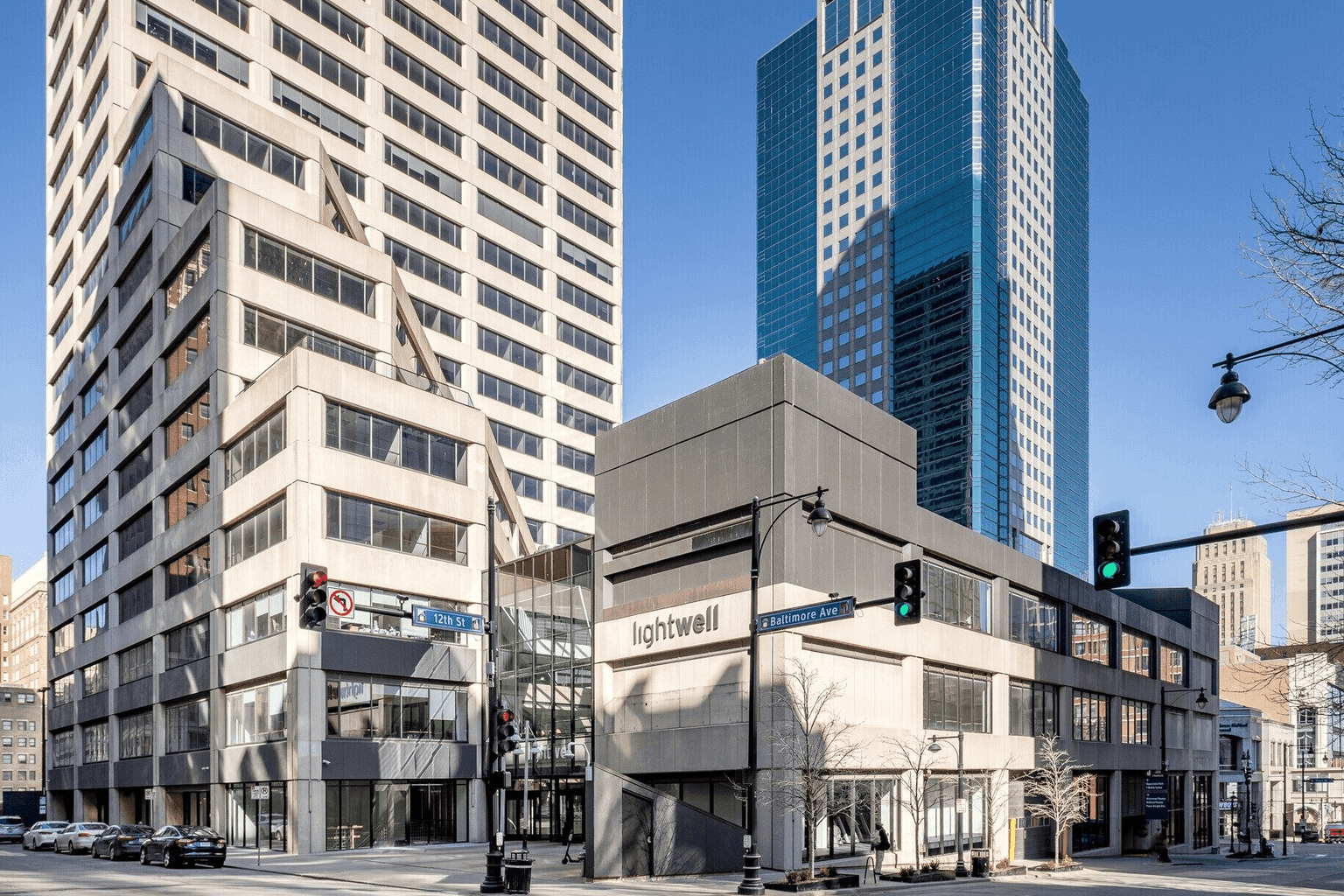

Lightwell

USD 900,000

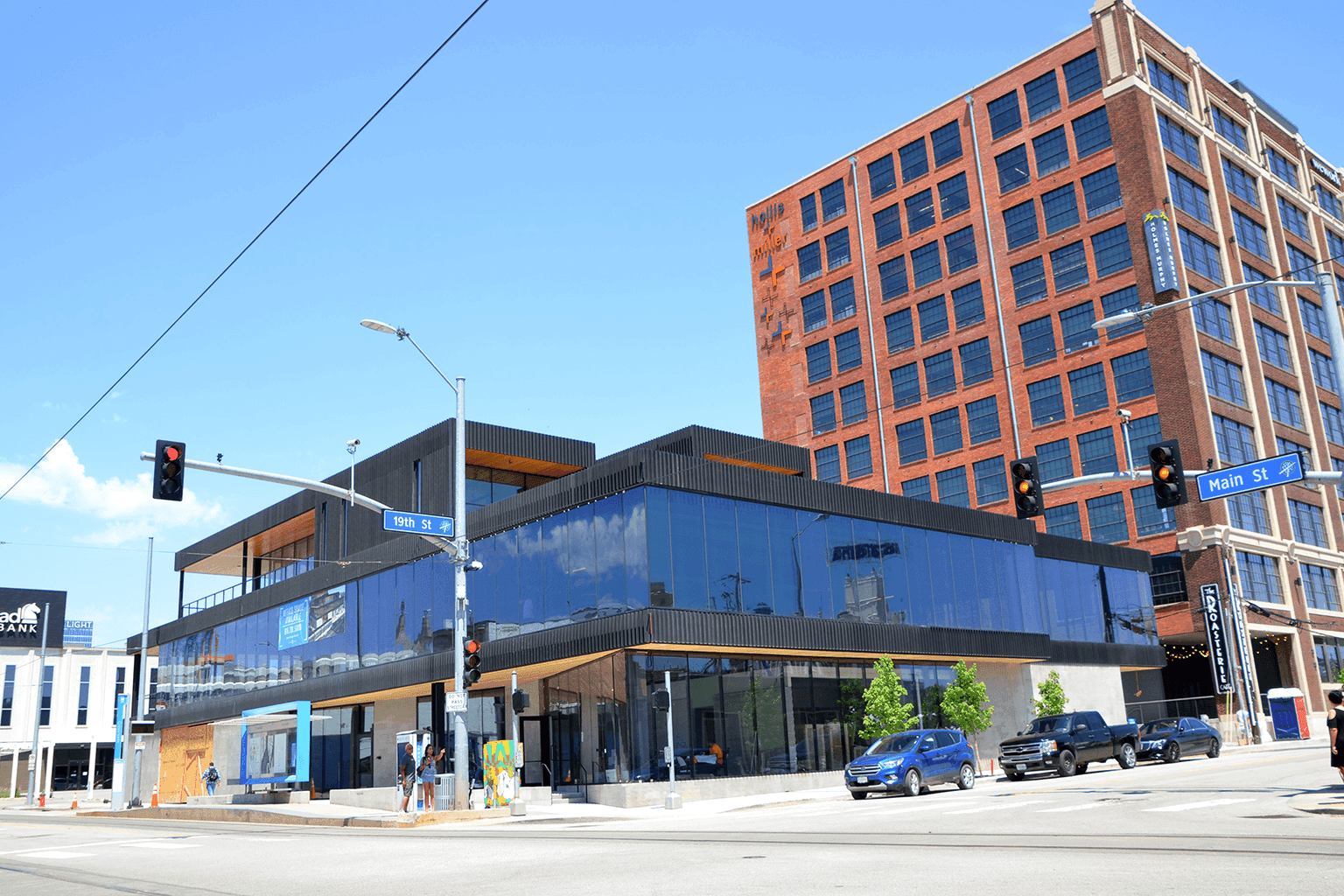

Corrigan Station Phase II

USD 0

Truman’s Landing

USD 300,000

531 Grand

USD 1,750,000

€38,888.889/m²

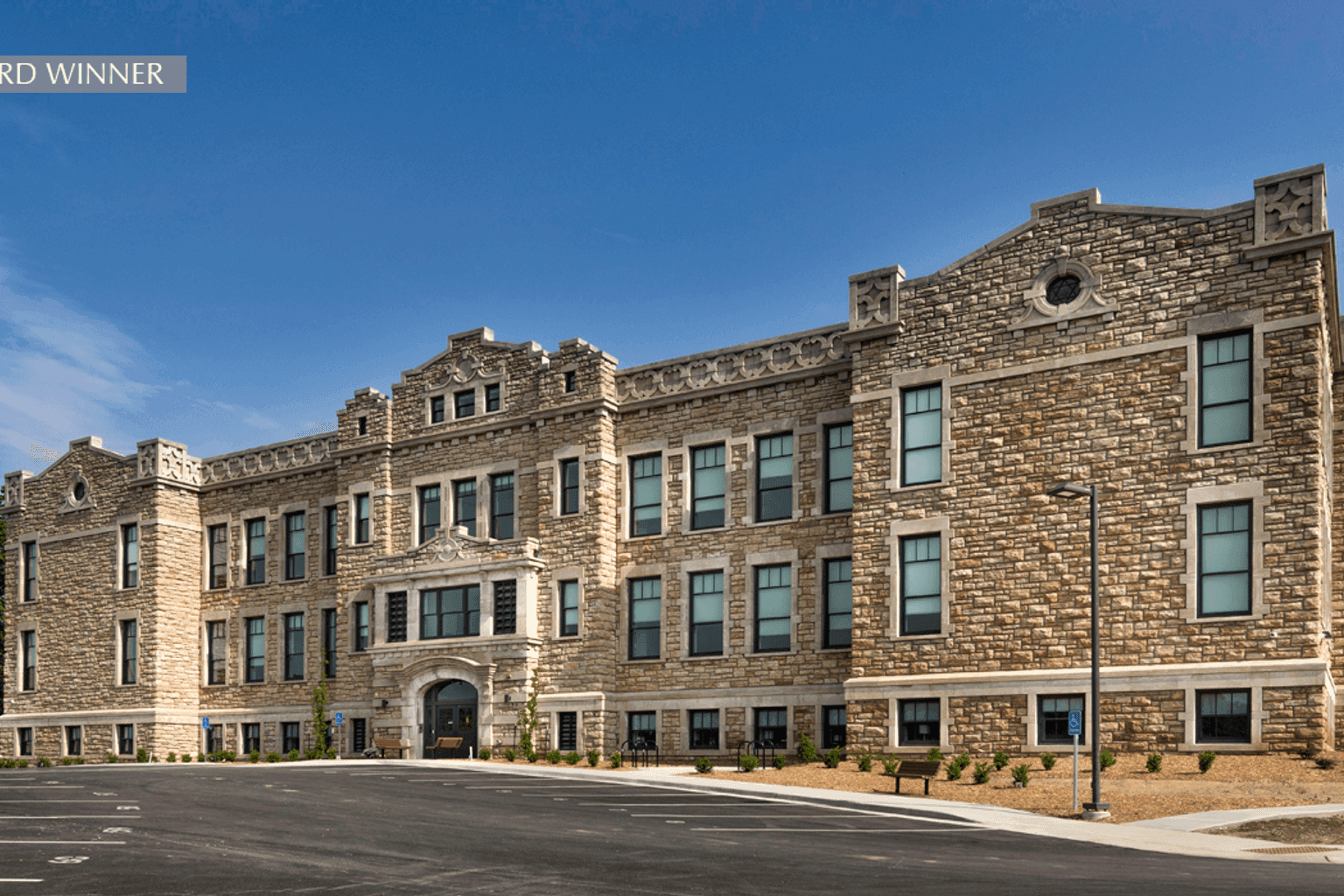

Norman School Lofts

USD 500,000

€9,433.962/m²

Trusted by International Investors

Over 10,000+ successful property investments facilitated in Kansas city

Other Cities near Kansas city

Explore investment opportunities in nearby cities within United states.

New York

Explore properties in New York, United States

Avg. Price: €

2500 properties available

Los Angeles

Explore properties in Los Angeles, United States

Avg. Price: €

2000 properties available

Miami

Explore properties in Miami, United States

Avg. Price: €

1600 properties available

Atlanta

Explore properties in Atlanta, United States

Avg. Price: €

400 properties available

Financing & Legal Information

Essential information for property investment in United states.

Financing Options

- Max LTV:70%

- Interest Rates:3.0-5.0%

- Loan Terms:Up to 30 years

Legal Considerations

- Foreign Ownership:Freely allowed

- Process Time:Typically 8-12 weeks

Key Requirements:

Find Your Perfect Property in Kansas city

Our local specialists are ready to assist you. Get personalized property recommendations and expert guidance.