Properties For Sale in Hong kong, Sar 2026

Discover premium real estate opportunities in one of Sar's most sought-after locations.

OASIS KAI TAK

SAR 5,100,000

KOKO Hills

SAR 6,180,000

77/79 Peak Road

SAR 500,560,000

€41,713,333.333/m²

West Kowloon Cultural District

HKD 0

Wings at Sea

SAR 4,500,000

€409,090.909/m²

Victoria Harbour

SAR 9,000,000

€272,727.273/m²

Emerald Bay

HKD 0

Taikoo Place Apartments

USD 18,000,000

€409,090.909/m²

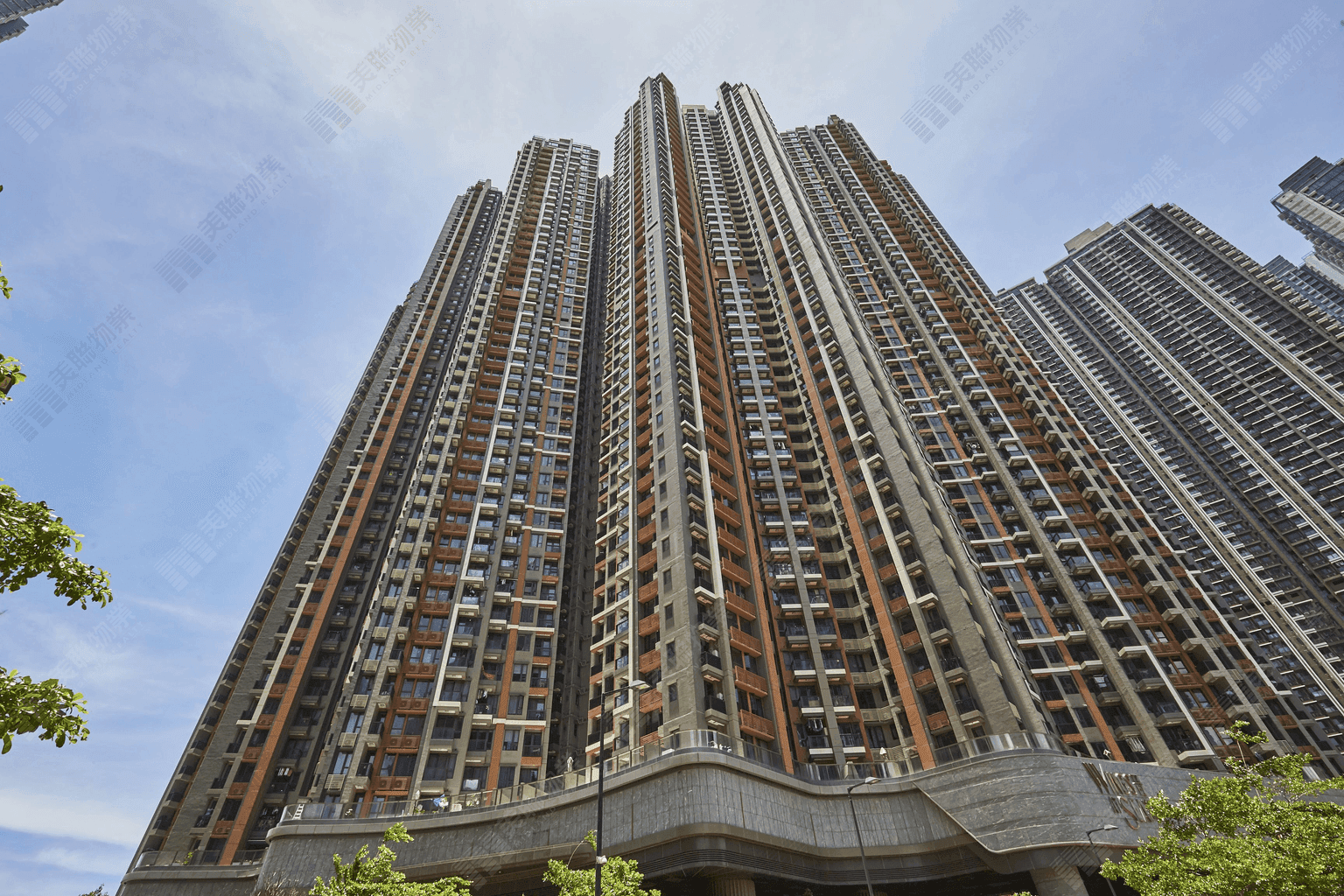

Grand YOHO

SAR 5,360,000

The Papillons

SAR 4,280,000

Grand Central

SAR 6,900,000

Southland

HKD 0

Mount Pavilia

SAR 8,500,000

€193,181.818/m²

LOHAS Park

USD 20,000,000

€454,545.455/m²

Upper RiverBank

SAR 6,380,000

T Plus

USD 1,830,000

€166,363.636/m²

Starfront Royale

SAR 2,988,000

€175,764.706/m²

Trusted by International Investors

Over 10,000+ successful property investments facilitated in Hong kong

Other Cities near Hong kong

Explore investment opportunities in nearby cities within Sar.

Frequently Asked Questions About Hong kong

Common questions about property investment in Hong kong, Sar

Find Your Perfect Property in Hong kong

Our local specialists are ready to assist you. Get personalized property recommendations and expert guidance.

About Hong Kong, Hong Kong SAR

Hong Kong, a vibrant metropolis situated on the southern coast of China, is a dynamic blend of East and West. As a major financial hub and cultural center, it offers a cosmopolitan lifestyle with breathtaking views of the harbor and skyline. Known for its bustling urban life, Hong Kong is an attractive place to live and invest, boasting a strong economy and diverse cultural scene.

Property Types

- •Apartments

- •Villas

- •Houses

Lifestyle & Amenities

- •World-class beaches

- •Thriving cultural scene

- •Vibrant nightlife

- •Renowned international schools

Investment Potential

Hong Kong's real estate market is a prime choice for investors seeking strong rental demand and capital appreciation. The city's thriving economy and strategic location make it a desirable destination for both residential and commercial property investment. With continuous infrastructure development and a steady influx of tourists, buying property in Hong Kong offers promising returns.

Frequently Asked Questions About Hong Kong, Hong Kong SAR

Get answers to common questions about buying property in Hong Kong.