Properties For Sale in Manila, Philippines 2026

Discover premium real estate opportunities in one of Philippines's most sought-after locations.

Preselling Condo walking distance to UST (U-Belt) Espana Boulevard

Key Features:

3 BEDROOM READY FOR OCCUPANCY FOR SALE IN SUNTRUST SOLANA

Premium Townhouse with 4-bedrooms For Sale in Manila

SMDC CONDOS PRESELLING AND RFO UNITS

14 DOORS APARTMENT FOR SALE IN SAMPALOC MLA...WALKING DISTANCE TO UST

MIDAS HOTEL AND CASINO

coast residences family suite B-Penthouse

60 sqm Residential Lot For Sale in balic balicManila

SMDC BREEZE RESIDENCES STUDIO WITH BALCONY

Ready For Occupancy 119.74 sqm 2-bedroom Residential Condo For Sale in Manila

Key Features:

Luxury 4-Bedroom Townhouse in Paco with 378 sqm Floor Area

3M TOTAL PRICE CONDO RFO IN STA. MESA MANILA LRT2 V.MAPA STATION SM STA. MESA UBELT AREA

Key Features:

Foreclosed Green Residences Residential Condo for sale near De La Salle University

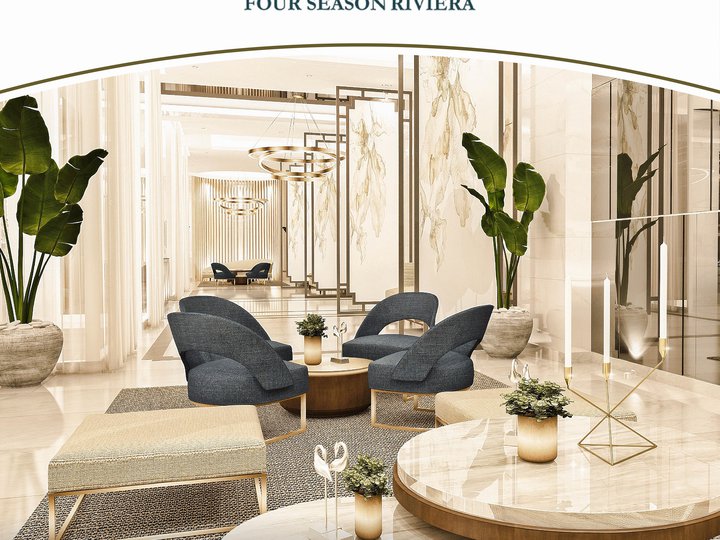

Four Season Riviera: Luxury Condo Units in Manila

Key Features:

Ready For Occupancy 51 sqm 3-bedroom Residential Condo For Sale in Manila

Key Features:

Contemporary Condo Near Manila Landmarks

Key Features:

Modern Japanese-inspired 1BR condo unit in Malate with pool and gym - Kizuna Heights

Key Features:

Avida Towers Intima 1 Bedroom Unit Condominium For Sale in Paco Manila by Avida Land Corp +

Luxury 1-Bedroom Condo in Malate with Park and Manila Sunset Views

AMAIA SKIES TOWER 2 CONDOMINIUM FOR SALE IN STA MESA MANILA

Key Features:

Big 1 Bedroom Condo 4 sale in Malate Manila nr DLSU Camden Place DMCI

Key Features:

Visit this Property Now! Suntrust Solana Manila Ready for Occupancy Condo for Sale Bank Loan Assist

Key Features:

Preselling Condo for Sale SMDC Sands Residences Roxas Boulevard: Stretched Downpayment; Bank Loan

Key Features:

Armada Hotel Manila Offers Established Commercial Property in Metro Manila

Affordable 52sqm 3-bedroom Residential Condo For Sale in Solana - Suntrust

Key Features:

Pre-selling generating income condo besides P.U.P Unversities near SM Sta Mesa & hospital

Ready For Occupancy 52sqm 3-bedroom Residential Condo For Sale in Solana - Suntrust

Key Features:

Ready For Occupancy 182 sqm 4-bedroom Residential Condo For Sale in Manila

Key Features:

STA. MESA Commercial Space For Sale in 6,469 sqm NHS00006

Lot for Warehouse/Office in Malate Manila near Quirino Ave for sale

Foreclosed 28.03 sqm 1-bedroom Residential Condo For Sale in Manila

Prime student condo in Manila's University Belt - Crown Tower

Key Features:

Four Season Riviera: Luxury Condo Units in Manila

Key Features:

33 sqm Smart Studio Residential Condo in the Heart of Manila

Key Features:

Spacious 50.20 sqm 2-bedroom condo in prime Manila location

Key Features:

Contemporary Luxury 4BR Townhouse in Paco, Manilas Quiet Core

Torre De Manila 3 Bedroom Condominium Unit with Parking For Sale in Taft Ave. Manila

SPACIOUS 3BR CONDOMINIUM IN SUNTRUST ASCENTIA STA ANA MANILA NEAR HOSPITALS

Key Features:

High-End Townhouse with 4-bedrooms For Sale in Manila

Limited RFO 2 Bedroom Unit ,52.10 sqm , Residential Condo in Sta Mesa Manila

The Estate Makati

PHP 90,000,000

MOA Complex (SM Bay City)

PHP 3,200,000

€128,000/m²

Greenhills Center Redevelopment

PHP 0

Northwin Global City

PHP 8,800,000

€258,823.529/m²

Uptown Bonifacio

PHP 14,400,000

€240,000/m²

McKinley West

PHP 12,000,000

€200,000/m²

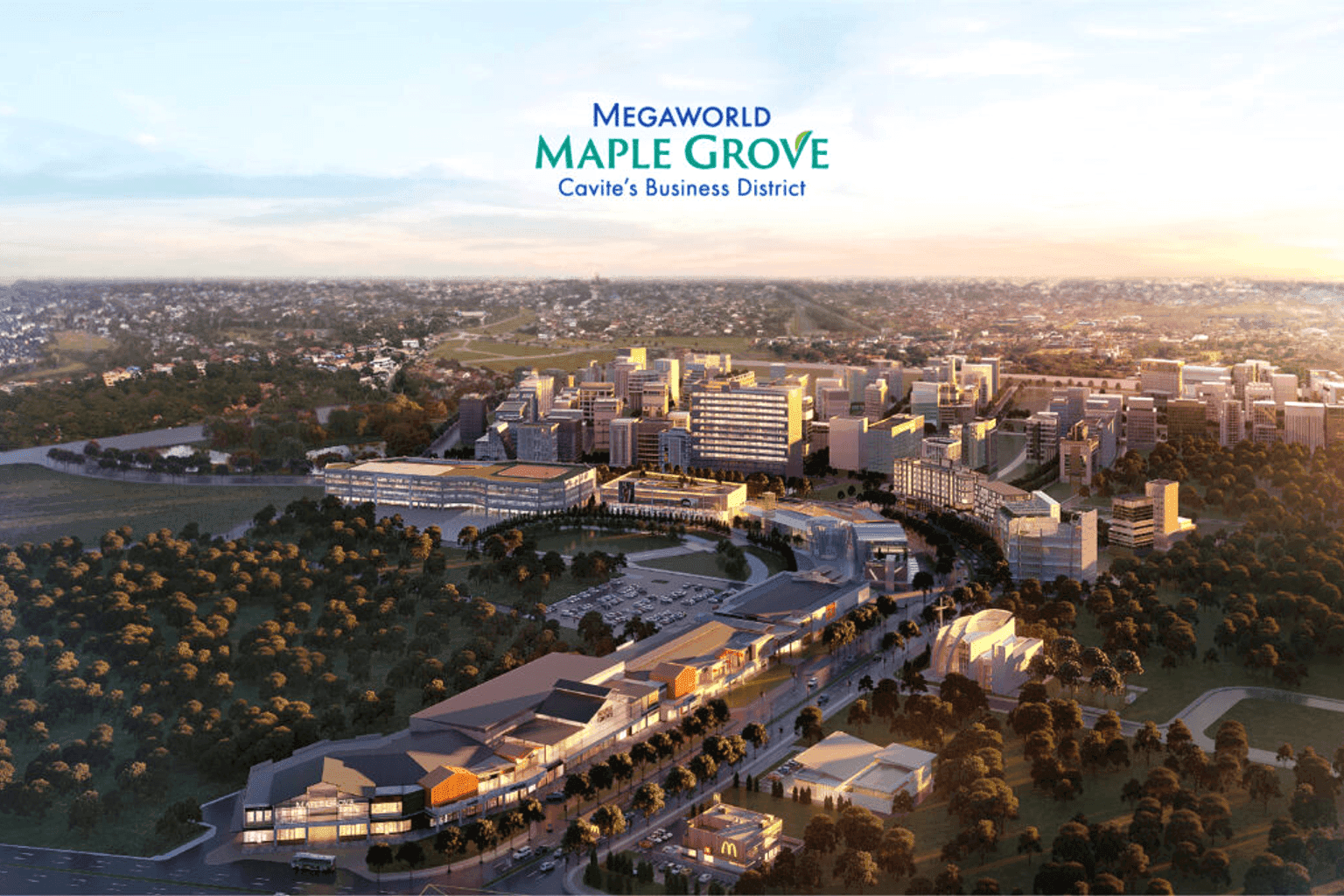

Maple Grove

PHP 4,000,000

Horizon Manila

PHP 3,000,000

€50,000/m²

Trusted by International Investors

Over 10,000+ successful property investments facilitated in Manila

Other Cities near Manila

Explore investment opportunities in nearby cities within Philippines.

Quezon City

Explore properties in Quezon City, Philippines

Avg. Price: €

151 properties available

Pasig

Explore properties in Pasig, Philippines

Avg. Price: €

101 properties available

Calamba

Explore properties in Calamba, Philippines

Avg. Price: €

86 properties available

Makati

Explore properties in Makati, Philippines

Avg. Price: €

77 properties available

Financing & Legal Information

Essential information for property investment in Philippines.

Frequently Asked Questions About Manila

Common questions about property investment in Manila, Philippines

Find Your Perfect Property in Manila

Our local specialists are ready to assist you. Get personalized property recommendations and expert guidance.

About Manila, Philippines

Manila, the vibrant capital of the Philippines, is a coastal city known for its bustling business hubs and rich cultural heritage. As a dynamic center for trade and commerce, it offers a unique blend of modern living and historical charm, making it an ideal place to live and invest.

Property Types

- •Apartments

- •Villas

- •Houses

Lifestyle & Amenities

- •Stunning beaches

- •Rich cultural experiences

- •Vibrant nightlife

- •Renowned international schools

Investment Potential

Manila properties promise excellent investment potential due to strong rental demand, booming tourism, and continuous economic growth. With ongoing infrastructure developments, the city's real estate market is thriving, attracting expats, retirees, and savvy investors eager to buy property in Manila.

Frequently Asked Questions About Manila, Philippines

Get answers to common questions about buying property in Manila.